Selling a business is

a big decision.

Experience the

professional difference.

The support you need.

Benjamin Ross Group represents business owners who want to sell their businesses and leave their employees and customers in capable hands. We support our clients through the biggest business decision of their lives, so they can move on with confidence, peace of mind, and the most competitive price for their hard work.

A track record of success.

We sell 96% of the businesses we represent, compared to the national average of 20%. And we earn our clients’ trust because of our expertise, professionalism, and extensive network.

Our

sell rate

National

average

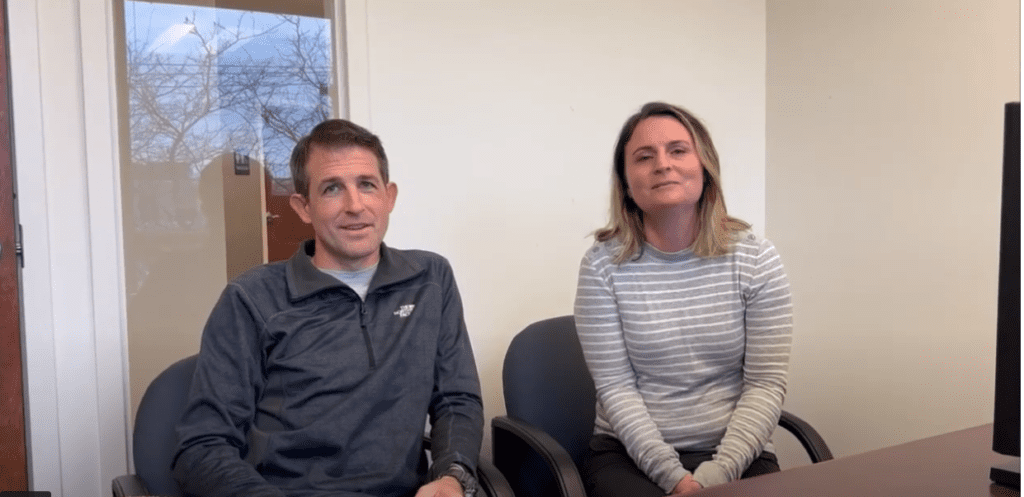

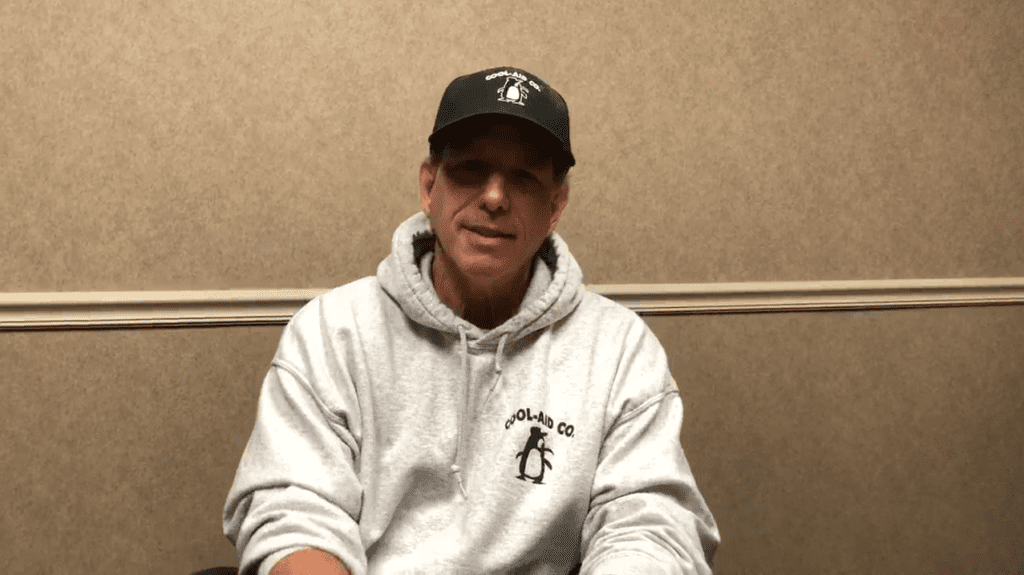

Hear from our clients.

Questions about selling a business?

Get in touch with one of our M&A experts.

Insight from the experts.

What every business owner needs to know.

Our book can teach you how to plan now to maximize the sale price of your business.

What to avoid when selling your business.

Deal Killers is a guide for business owners who will, at some point, consider the sale of their business.